How to Save Money on your Real Estate Sale in Mexico

It is very common for real estate in Mexico to be sold “furnished,” especially in Puerto Vallarta and other resort cities. While it has been common practice to include the furniture, appliances, art, and other goods under a single price for the property, this practice actually is financially harmful to both the buyer and seller of the property, and is technically not in compliance with the law.

In Mexico, as in the US, Canada, and elsewhere in the world, furniture, appliances, and other personal contents in a house are categorized as “personal property,” or “muebles.” Under Mexican law, these items are not “real property.” Personal Property is defined in the Federal Civil Code, Chapter II, Articles 752-763 (https://mexico.justia.com/federales/codigos/codigo-civil-federal/libro-segundo/titulo-segundo/capitulo-ii/#articulo-759).

Agents and clients should be aware of the benefits of separating the value of personal property from the real property transaction.

- Capital gains taxes (paid by the seller) are calculated on the sales price of the real property; personal property could be excluded for capital gains purposes

- Reverse capital gains taxes (paid by the buyer) are calculated on the sales price of the real property; personal property could be excluded from this calculation

- Real estate commissions are paid on the sales price of the real property; absent an agreement to the contrary, personal property is not included in this calculation

- Real Estate Transfer Tax (paid by the buyer) may be calculated on the sales price of the real property (varies by state or jurisdiction)

- The sale of used goods between non-taxpayer individuals (this is anyone who does not use the property for business, or who is not a corporation) is not subject to IVA (sales tax) (https://sovos.com/blog/mexican-value-added-tax-iva-system-general-overview-part/)

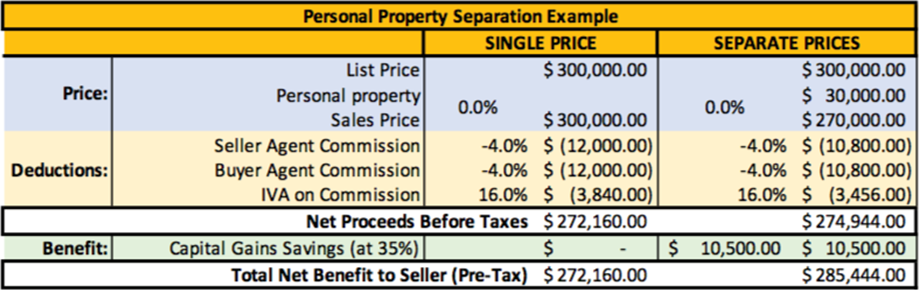

Here is an example of how a $300,000 USD transaction would be affected by this strategy (Seller’s perspective):

I am not suggesting that this should be the hard and fast rule to every real estate sale or purchase, but rather a tool that agents can use to create a fiscal strategy for their clients. This scenario can work very well when a buyer and seller are just a few thousand dollars apart on an agreed upon price. This example however cannot be used for real property that is being used as a business.