Why Home Insurance Doesn’t Work in México?

There is a common misconception that insurance in Mexico is ineffective, and unfortunately, there is some truth to it. Like any statement, certain conditions must be considered. When it comes to home insurance, the coverage may not be adequate due to reasons such as inaccurate property declarations, scams, or the absence of additional coverage. It is crucial to ensure proper protection and explore all available options to avoid any potential pitfalls that may arise. By doing so, individuals can have peace of mind knowing that they have taken the necessary steps to safeguard their assets and mitigate potential risks.

You may be wondering how to proactively avoid future scenarios that could jeopardize your investment. Unfortunately, insurance is a financial tool that can easily be misused, with the consequences often not realized until years or even decades later. There are some key points to verify before paying your insurance policy.

Underestimating The Risk

It is important not to underestimate the risk involved, as doing so can lead to unforeseen consequences and potential harm. Taking the time to carefully assess and evaluate the risks can help in making informed decisions and taking appropriate actions to mitigate them.

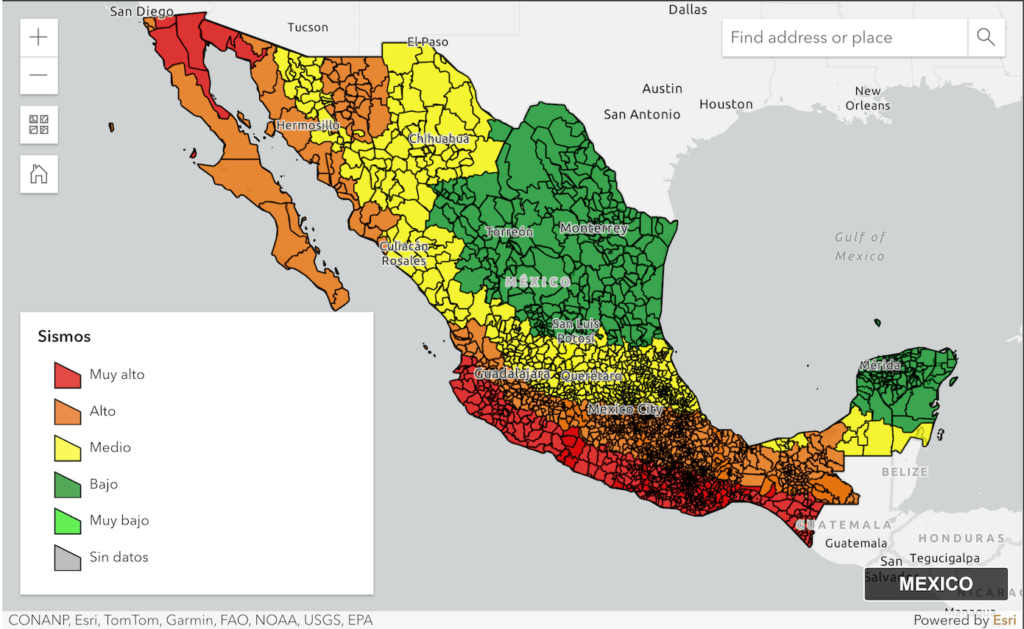

Earthquake and/or Volcanic Eruption

Mexico is divided into different earthquake zones, ranging from A (no activity recorded in the past 80 years) to D (frequent and high-magnitude activity). It is crucial to have additional coverage if your property is located in zones B, C, or D, as standard policies typically do not provide earthquake coverage in their primary plans. Ensuring this coverage is essential to protect yourself and your property in case of seismic events.

The cost of additional premiums for this coverage can range from 80% to 120% of the main premium, depending on the zone and the insurance company. Typically, this coverage comes with higher deductibles and coinsurance. However, there are insurance companies that offer policies without deductibles or coinsurance, albeit at a higher cost.

Source: http://www.atlasnacionalderiesgos.gob.mx/

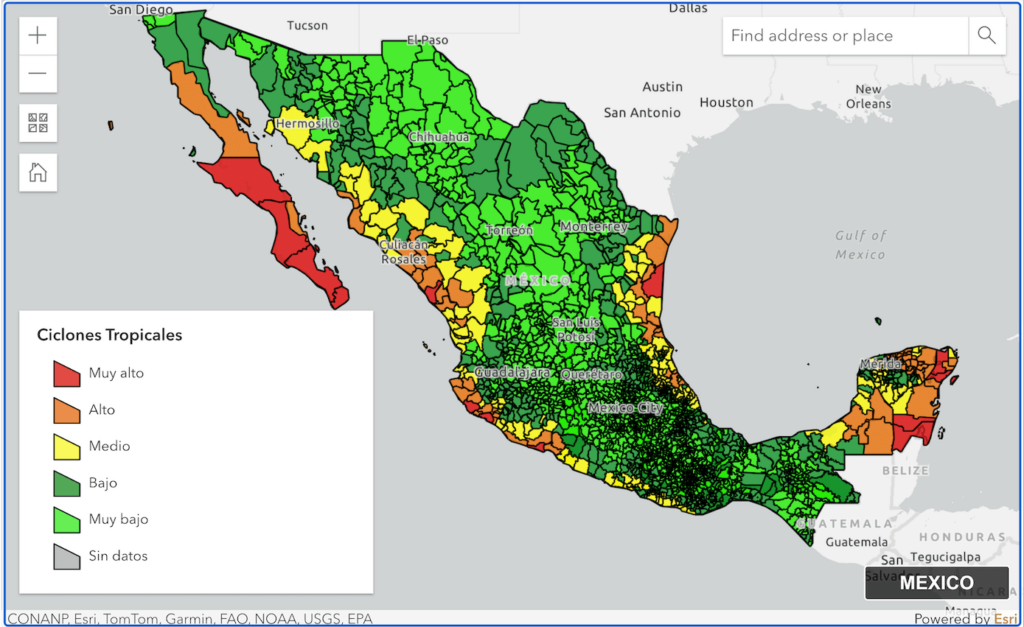

Hydrometeorological Phenomenon

When discussing hydrometeorological phenomena, we delve into various types of risks, including hurricanes, tsunamis, and other weather events. It is crucial to understand that these occurrences are not included in the main homeowner’s policy in Mexico, this is an additional coverage in the standard policies. It is highly recommended to add this coverage if your property is located in an area prone to these phenomena.

A common misconception people have is: “Hurricanes or floods may be destructive, but they won’t impact my property significantly.” While this assumption holds some truth, it fails to consider the indirect risks involved. The sheer magnitude and destructive force of hurricanes and floods leave behind a trail of wreckage, serving as a grim reminder of the overwhelming power of nature. Even if your property is not affected by these phenomena, the debris can still cause significant damage.

The cost of additional premiums for this coverage can range from 60% to 100% of the main premium, depending on the zone and the insurance company. Typically as in Earthquakes, this coverage comes with higher deductibles and coinsurance.

Source: http://www.atlasnacionalderiesgos.gob.mx/

Inaccurate or false declarations

Just like with any other type of insurance, this is considered a grave offense in the insurance industry, and engaging in such activities can even lead to imprisonment. One common scenario occurs when the property is situated in proximity to a body of water. The Mexican legislation establishes the following definitions and distances:

Oceanfront, Lakefront, or Lagoonfront Locations

When you have a property consisting of multiple structures, the structure directly facing the body of water is:

a) 500 meters from the point where waves break at high tide.

b) 250 meters from the shoreline of a lake or lagoon. (This includes rivers, swamps, or any other body of water)

Failing to disclose this information provides the insurance company with an opportunity to conveniently evade responsibility by excluding coverage due to inaccurate declarations. Including this additional clause in your overall pricing adds an extra premium, typically ranging from 15-35% depending on factors such as the company, location, and property type.

If your property is near a body of water such as a river, sea, lake, or lagoon, it’s crucial to inquire with your agent about their consideration of this factor when evaluating a property. This can help prevent potential complications and ensure that your insurance claims will be processed smoothly.

Low price Insurance

In the realm of insurance, discounts or sale offers are elusive; there is always a price to be paid. Considering a low premium can bring higher deductibles or coinsurance, less coverage, or even a financially unstable insurer. Going with the cheapest option may save you some cash in the short term but can end up being significantly more expensive in the long run if something happens and your insurance company will not cover the damages.

In Mexico, insurance premiums depend on the risk associated with your property. The higher the risk, the higher the premiums. While insurance costs in México may be slightly lower compared to the USA or Canada, if your property is located in a high-risk zone, the difference won’t be significant.

Insurance in México works if you choose wisdom, honesty, and the right agency. Always inquire about the factors that may affect your policy, and review the coverage clauses and their limits. Keep in mind that insurance is there to protect you and your property; don’t be afraid to ask questions or seek clarification from your agent. Your investment deserves proper protection, and it’s crucial to take all necessary precautions to safeguard it.

Contact us now and ask about home insurance.